Buying insurance is not just a financial decision—it is a long-term commitment that protects you, your family, and your assets against unexpected risks. Whether you are purchasing health, life, car, or travel insurance, understanding the key factors before buying any policy can help you avoid costly mistakes and future stress.

This guide explains the most important elements you must evaluate to make a smart and future-proof insurance decision—especially in Tier-1 countries like the USA, UK, Canada, and Australia, where insurance costs and claim scrutiny are high.

Why Choosing the Right Insurance Matters

- Financial protection during emergencies

- Peace of mind for you and your family

- Reduced out-of-pocket expenses

- Better long-term financial planning

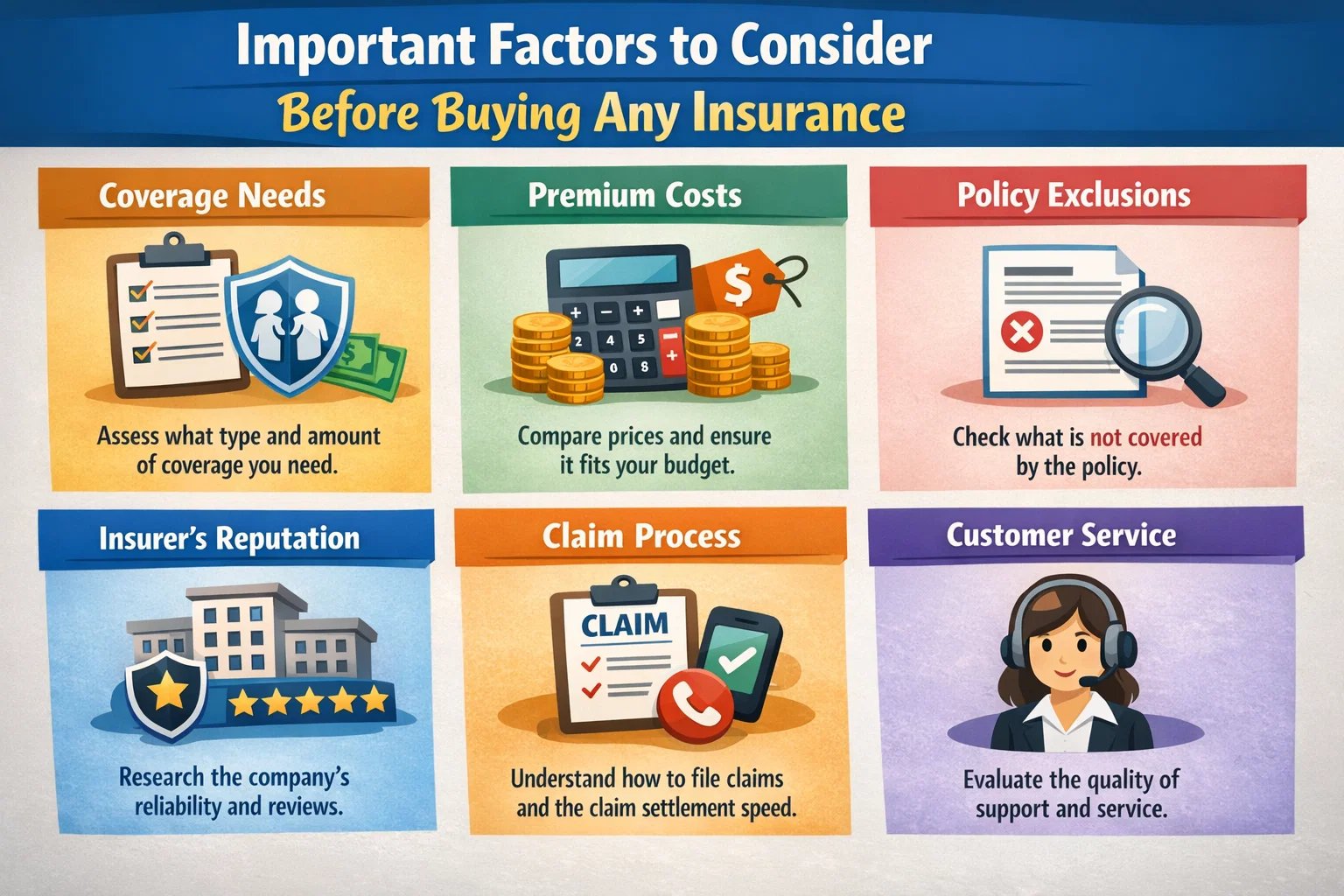

Factor 1: Identify Your Real Insurance Needs

Every individual faces different risks based on income, dependents, lifestyle, and location.

- Which risks need protection?

- Do you have financial dependents?

- What assets must be secured?

- How much coverage is sufficient?

Factor 2: Choose the Correct Insurance Type

| Insurance Type | Primary Purpose |

|---|---|

| Health Insurance | Medical and hospitalization expenses |

| Life Insurance | Financial protection for dependents |

| Car Insurance | Vehicle damage and liability coverage |

| Travel Insurance | Trip-related emergencies and medical risks |

Factor 3: Select the Right Coverage Amount

Too little coverage creates financial risk, while excessive coverage increases premiums unnecessarily.

- Income replacement needs

- Outstanding loans and liabilities

- Medical inflation in Tier-1 countries

- Future expenses of dependents

Factor 4: Check Premium Affordability

A low premium should never be the only reason to choose a policy. Cheap plans often include higher deductibles, strict exclusions, or limited coverage.

Factor 5: Review Policy Inclusions Carefully

- Hospitalization and emergency services

- Worldwide or Tier-1 country coverage

- Critical illness or disability benefits

- Cashless claim facilities

Factor 6: Understand Exclusions and Limitations

- Pre-existing conditions

- Self-inflicted injuries

- Alcohol or substance-related incidents

- High-risk activities or war events

Factor 7: Deductibles and Co-Payments

Higher deductibles reduce premiums but increase your expenses during claims. Balance affordability with realistic emergency costs.

Factor 8: Claim Settlement Ratio and Process

- Check insurer’s historical claim approval rate

- Read real customer feedback

- Understand required documentation

Factor 9: Insurer Reputation and Financial Strength

Always choose insurers with strong financial ratings, transparent operations, and reliable global presence.

Factor 10: Policy Term and Renewal Rules

- Lifetime renewability options

- Guaranteed renewal clauses

- Premium increase history

Factor 11: Riders and Add-On Benefits

- Critical illness rider

- Accidental death benefit

- Waiver of premium

- Zero depreciation for vehicle insurance

Factor 12: Long-Term Cost vs Short-Term Savings

Always evaluate insurance over 5–20 years instead of focusing only on the first-year premium.

Factor 13: Tax Benefits and Compliance

Insurance premiums often provide tax deductions, improving total financial value—though tax savings should never be the sole reason to buy insurance.

Common Mistakes to Avoid

- Buying without comparing policies

- Choosing based only on premium

- Ignoring exclusions and fine print

- Under-insuring or over-insuring

- Blindly trusting agents

Expert Tips Before Buying Insurance

- Compare at least 3–5 policies

- Match coverage with real-life risks

- Review policies every year

- Keep documentation organized

- Choose transparency over branding

Final Thoughts

Understanding the important factors before buying any insurance empowers you to make confident and financially sound decisions. In a world of rising healthcare costs, strict claim rules, and complex policy structures, careful evaluation is essential.

The right insurance policy doesn’t just protect your money—it protects your future.